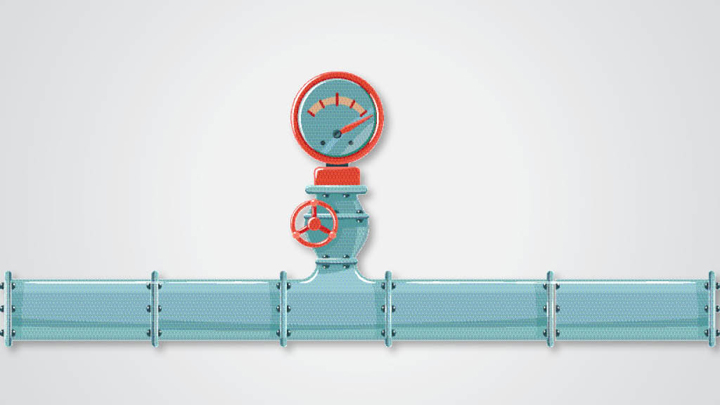

Oil Glut Trouble

Tuesday, April 28, 2020

arsip tempo : 171348247340.

THERE are signs that the Covid-19 pandemic is starting to improve. Globally, the graph depicting the number of new cases per day is flattening. In the United States, the country with the highest number of confirmed cases, the debate has moved on to when the economy should be reopened so that conditions return to normal.

To many, the economic burden has become unbearable. The shutdown of economic activity due to Covid-19 has had dire consequences

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More