Upstream Chaos

Tuesday, April 28, 2020

arsip tempo : 171400781562.

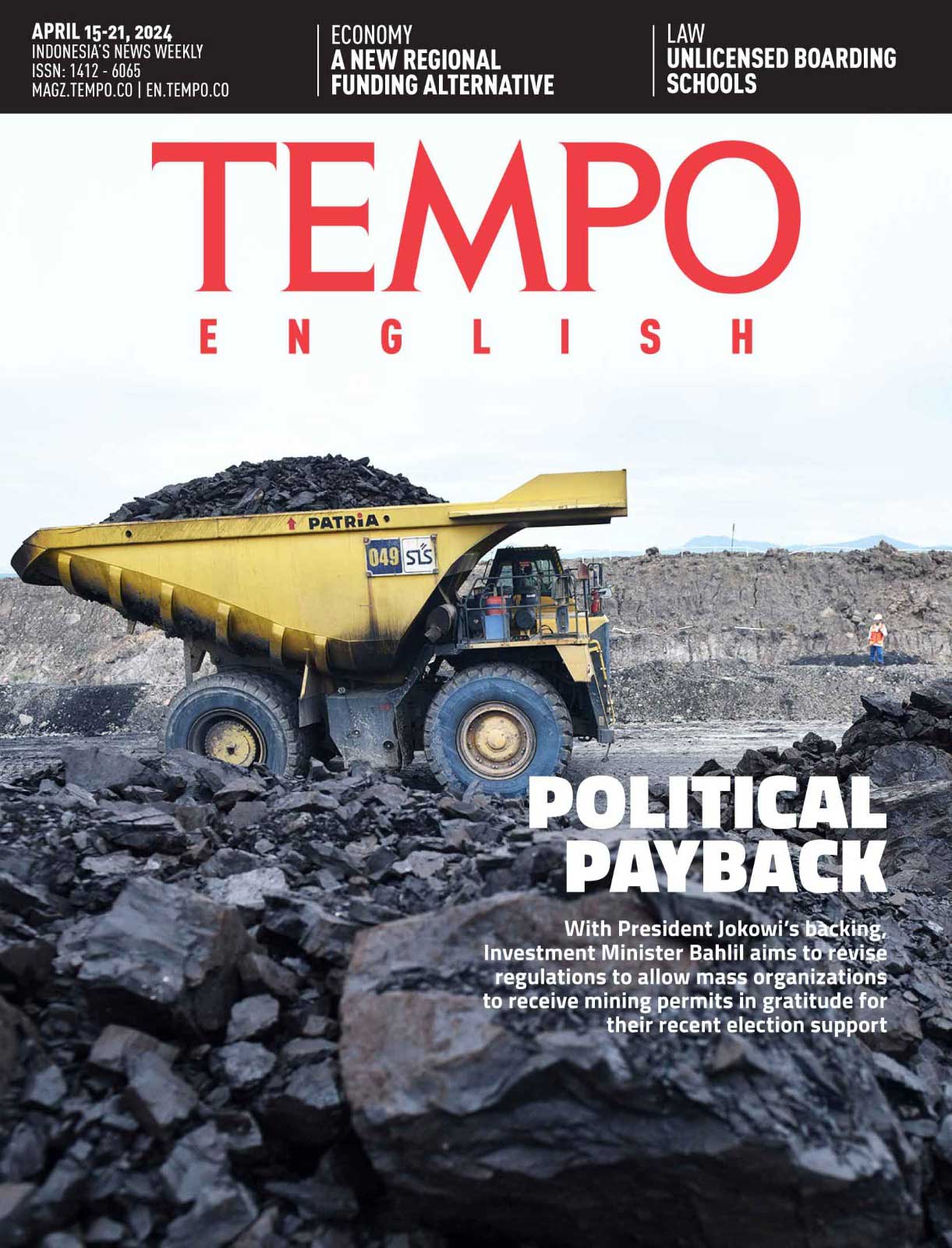

THE flyover at Ngraho village in the Gayam subdistrict in East Java’s Bojonegoro has been quiet since restrictions are in place in mid-March to combat the Covid-19 pandemic. On Thursday, April 23, the ramp towards the location for two projects at the unitized Jambaran-Tiung Biru (JTB) gas field was no longer jammed with heavyweight vehicles.

On location, some seven kilometers from the Bojonegoro-Ngawi-Blora road, 3,504 people were seen at

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More