The Danger of Mismanaging Bullion Banks

The establishment of bullion banks needs good risk management and close oversight. It could have systemic implications.

Tempo

March 10, 2025

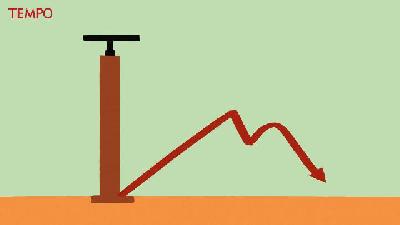

THE government must act responsibly in the management of bullion banks owned by state companies. Ignoring the significant potential risks from this new model of accumulating funds from the people could lead to major problems and disrupt the economy.

President Prabowo Subianto officially inaugurated the bullion banking services of Pegadaian and Bank Syariah Indonesia on February 26. It has been claimed that these services will strengthen the precious metals commodity business from top to bottom and will boost gross domestic product by 1.6 percent, or Rp245 trillion. As well as this, it is expected that the gold industry will create up to 1.8 million jobs and provide an opportunity to monetize gold reserves to improve development liquidity.

In the initial stage of operations, bullion banks will provide four services: gold deposits, financing, trade and custody. Drawn up during the administration of Joko Widodo, provisions for bullion banking are included in Law No. 4/2023 on the Development and Strengthening of the Financial Sector. One reason for starting the establishment of bullion banks is the huge potential for gold that can be collected from within the country.

The establishment of bullion banks could be a promising breakthrough, especially since many people do not keep gold with informal institutions but at home or concealed in other locations. The gold reserves in the formal financial sector are only 201 tons, while private individuals hold a further 1,800 tons of gold, and are believed to be worth around Rp300 trillion.

Given the way Prabowo views the bringing together and managing of state assets, concerns have arisen about gold or public funds put into these bullion banks. These concerns are heightened because the bullion banks will be under the control of Daya Anagata Nusantara, or Danantara, a body established by Prabowo to manage all the assets of state-owned companies. There are concerns that assets in the form of gold and funds collected could be used for ambitious government projects currently delayed as a result of the budget deficit.

It is true that a number of other nations have set up bullion banks and have successfully developed complex derivative products. But the situation in Indonesia is very different, as even crucial details about the bullion guarantee agency and the amount of gold guaranteed by the state have yet to be clarified. The lack of regulations could lead to problems.

Encouraging the development of bullion bank services requires careful consideration. After all, there was the example of derivative products with collateral in the form of bank securities that led to the subprime mortgage crisis in the United States, which was systemic and which led to a risk of money laundering in bullion banks that had to be mitigated.

Therefore, the government must ensure that bullion banks are managed extremely cautiously, employing very strict risk management. Without careful calculations regarding changes in the gold price, any failure of these bullion banks could turn into a serious problem within our banking system. Customers would no longer trust the government, and the end result would be severe disruption to the national economy.