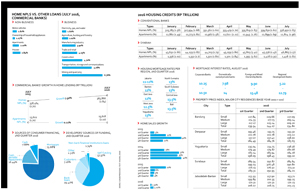

Getting Around the Rules

Tuesday, October 25, 2016

The dream of Rani Bautista (not her real name) of buying her first home was almost ruined when the bank only granted part of her mortgage application at the end of last year. She had asked for Rp650 million, but her bank only approved Rp450 million. "At the time we wanted to cancel the deal," said Rani, 32, recently.

Newcomers to the business, Rani and her husband wanted to buy a home using a mortgage (KPR) but without any down payment. They used a common strategy for first-home buyers with insufficient funds: inflating the house price. This required them to collaborate with the developer.

arsip tempo : 174599157998.

The dream of Rani Bautista (not her real name) of buying her first home was almost ruined when the bank only granted part of her mortgage application at the end of last year. She had asked for Rp650 million, but her bank only approved Rp450 million. "At the time we wanted to cancel the deal," said Rani, 32, recently.

Newcomers to the business, Rani and her husband wanted to buy a home using a mortgage (KPR) but without any down payment. They used

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More