Market Pulse

Tuesday, November 18, 2014

Currency

Rupiahweakens Despite Better Trade Numbers

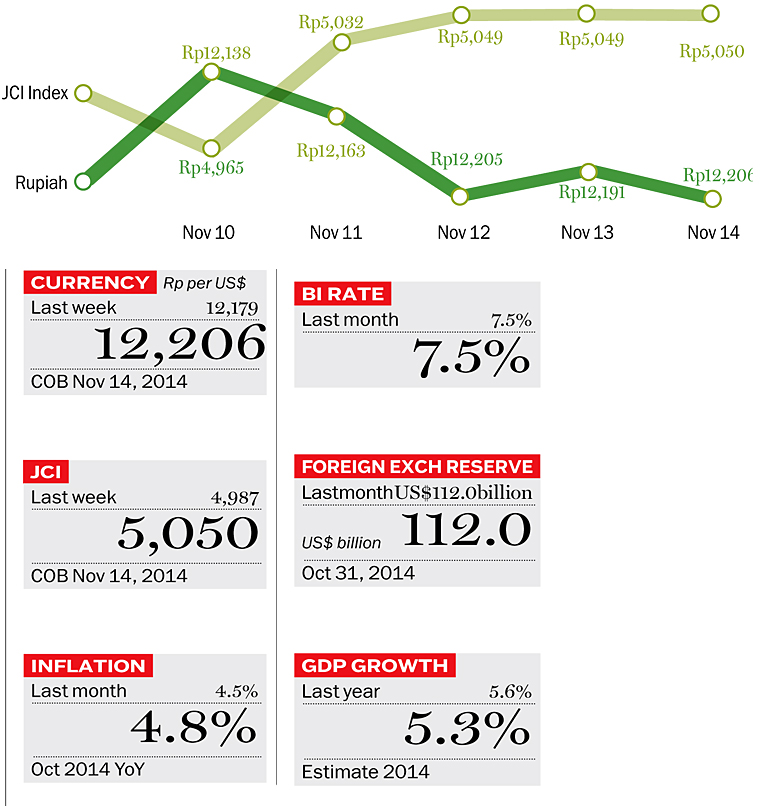

The Rupiah continues its weakening trend despite improved trade numbers. The strength of the USD and concerns about high private debt were the factors pushing the Rupiah to close at 12,206 per USD on Friday. Towards the end of the week the USD strengthened against the Japanese Yen and other regional currencies, including the Rupiah. As of August 2014, the country's foreign debt reached USD 290.4 billion, out of which more than half (USD 156.2 billion) is private. The concern is that this has raised the ratio of debt against export proceeds to 50.3%, exceeding the 30% comfort level.During the week, the government also announced a positive trade balance, driven largely by a drop in imports, as exports remained weak.In addition, the services account showed a lower deficit with subdued tradinglowering corresponding shipping payments. As a result, the current account deficit dropped to USD 6.8 billion in 3Q2014 from USD 9.1 billion a month ago and USD 8.6 billion a year ago. This translates into a 3Q2014 current account deficit ratio of 3.1% against GDP down from 4.3% a month ago. l

arsip tempo : 173506688638.

Currency

Rupiahweakens Despite Better Trade Numbers

The Rupiah continues its weakening trend despite improved trade numbers. The strength of the USD and concerns about high private debt were the factors pushing the Rupiah to close at 12,206 per USD on Friday. Towards the end of the week the USD strengthened against the Japanese Yen and other regional currencies, including the Rupiah. As of August 2014, the country's foreign debt reached USD 290.4

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More