The Difficulty of Cutting Interest Rates

Tuesday, December 1, 2015

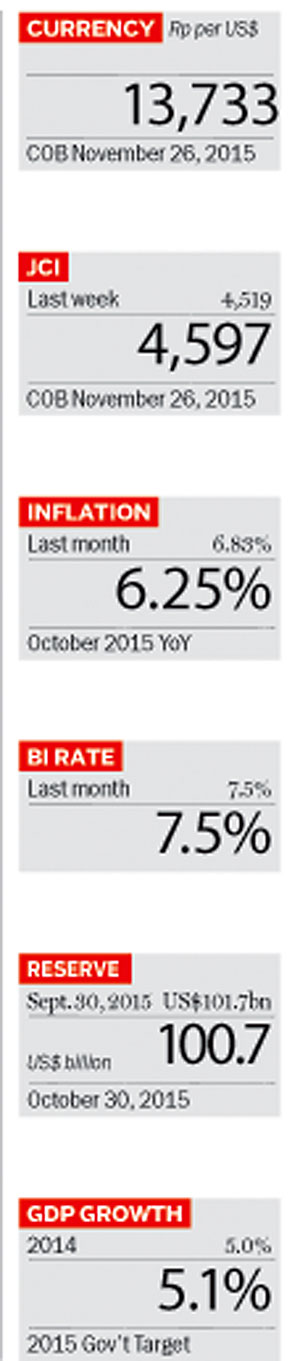

Pressure on Bank Indonesia (BI) to cut the rupiah interest rate and breathe some life into the lackluster economy is mounting. This is not just coming from businesses and consumers but also from the government, most notably from Economic Coordinating Minister Darmin Nasution and, more recently, Vice President Jusuf Kalla. Their request has some merit, with annualized October inflation declining to 6.25 percent and moving closer to BI's 4-5 percent year-end target. A lower interest rate, it is argued, would boost consumption and serve as an effective growth driver along with state spending.

But the central bank also carries the responsibility of maintaining a stable rupiah. Understandably, it worries about the currency weakening further should it cut rupiah interest rates. Thus, it must take into consideration the US Federal Reserve (the Fed)'s plan to raise the US interest rate before year's end. Most expect Bank Indonesia to cautiously wait and assess market reaction before deciding what to do with rupiah interest rates. Should the market remain calm with minimal foreign funds exiting and limited rupiah exchange rate volatility, then it could start lowering the interest rate. If funds rush out and hurt the rupiah significantly, depending on the extent of the volatility, it could maintain or even raise interest rates to prevent more funds from moving out.

arsip tempo : 174652111080.

Pressure on Bank Indonesia (BI) to cut the rupiah interest rate and breathe some life into the lackluster economy is mounting. This is not just coming from businesses and consumers but also from the government, most notably from Economic Coordinating Minister Darmin Nasution and, more recently, Vice President Jusuf Kalla. Their request has some merit, with annualized October inflation declining to 6.25 percent and moving closer to BI's 4-5 percent

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More