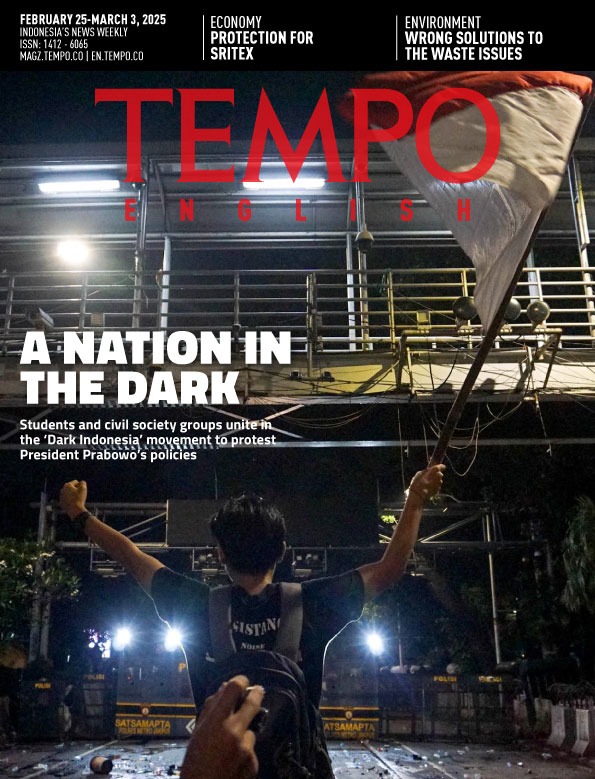

Youth are Driving Climate Action through Green Financing

Monday, April 25, 2022

arsip tempo : 174219480649.

The United Nations Development Program (UNDP) Indonesia together with the Ministry of Finance held a national webinar titled "Youth Participation in Financing Climate Action" on Wednesday, 27 April 2022. Targeting Indonesian youth, this event marks the start of the series of site visit activities for the Green Sukuk project that will be conducted throughout 2022, which will invite young investors to see firsthand the positive impact of their investments.

Youth are considered as the focal point of climate financing given the interesting trend of the Green Sukuk issuance report, which shows the active participation of young investors from millennials as well as Gen Z.

Since 2018, the Government of Indonesia with the support of UNDP has issued seven series of Green Sukuk to close the financing gap for climate change mitigation which is estimated to reach US$322 billion by 2030. To date, through four issuances in the global market and three issuances in the domestic market, the government has succeesfully raised US$4.2 billion.

Head of the Sub-directorate of Regulation and Legal Analysis of Islamic Finance, Ministry of Finance, Nana Riana, said that from domestic issuance, youth accounted for almost 50 percent of the distribution of investors by age group. According to him, the Green Sukuk issuance by the Government of Indonesia had recorded a number of achievements that can reinforce Indonesia's commitment to take an active role in overcoming climate change. "When the Green Sukuk was issued in 2018, it became the first sovereign green sukuk ever issued in the world to be used to address climate issues," he said.

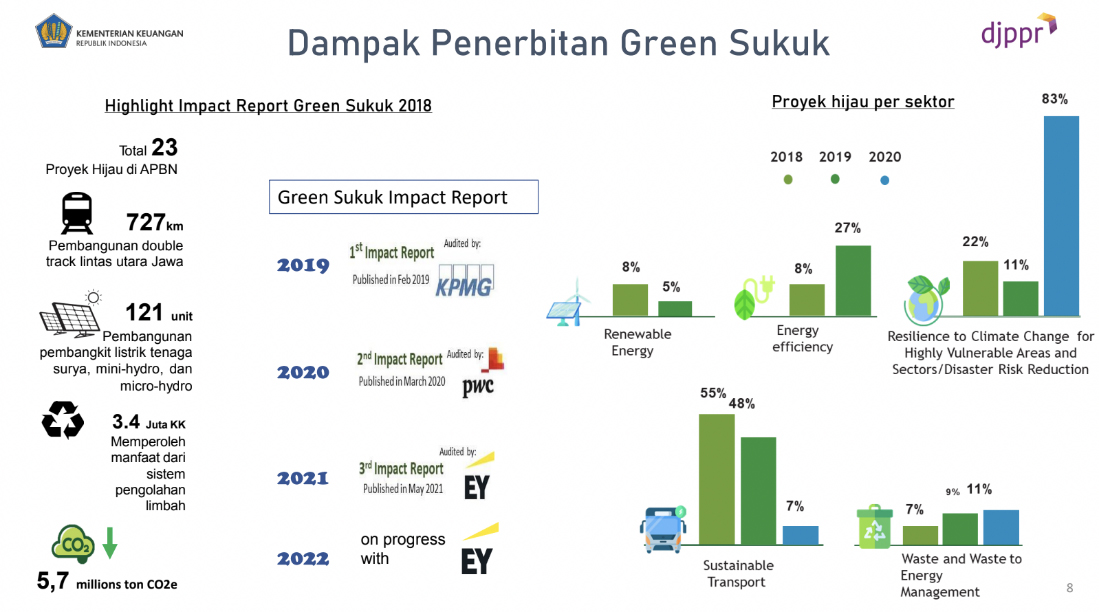

The impact of the Green Sukuk issuances, Nana continued, was already evident from various green projects including the construction of a 727-kilometer cross-Java double-track railway, 121 solar power plants, mini-hydro, and micro-hydro. In addition, 3.4 million households benefited from improved waste treatment system.

The Graphic of Green Sukuk.

Head of the Sub-Directorate of Project Management and State Sharia Securities Assets, Directorate General of Financing and Risk Management, Agus Prasetyo Laksono, in his speech, said that there was an increase in the participation of young people in financing to overcome the climate crisis.

“In the domestic market, the role of millennials is quite dominant. In three issuances, the average reached 43 percent. The success of retail green sukuk shows the dominance of the younger generation. Even from the research conducted by UNDP and the Ministry of Finance, as many as 60 percent of young people stated the importance of green financing," said Agus on behalf of the Director of Sharia Financing, Ministry of Finance.

This indicates that Indonesian youth have not only the financial capacity to invest but also the desire to invest for sustainability. It is believed that millennials' enthusiasm for buying retail Green Sukuk is caused by their awareness of investing for environmental and natural sustainability, in addition to interest in gaining financial benefits.

With these positive impacts, the Director of Sectoral and Regional Resource Mobilization of the Ministry of Environment and Forestry (KLHK), Wahyu Marjaka, encourages youth to be involved in green economic development in Indonesia. “Start with small steps such as managing waste. But that is certainly not enough because we have to take more steps, for example, with green sukuk," said Wahyu.

Engaging in climate change action efforts, according to the Environmental Economist and Co-Founder of Think Policy Indonesia, Andhyta Firselly Utami, can be triggered through awareness of conditions that may happen in the future. “As young people, we have a vision that after working hard and saving money, we wouldthen enjoy a prosperous and comfortable retirement. Okay, the mortgage is paid off and you have savings for retirement, but what is the use of all that if the earth is destroyed," she said.

However, the environmental economist who is commonly known as Afu also reminded us that the responsibility to save the Earth is not only borne by the young generation. Overcoming this climate crisis must be pursued together through shared awareness and proven by concrete actions. It is no longer the time to point at each other to take over the responsibility.

This spirit is in line with the material presented by the Technical Associate for Climate Finance, UNDP Indonesia, Debi Nathalia, who shared that UNDP’s Innovative Financing Lab has been supporting stakeholders in unlocking finance for the achievement of the Sustainable Development Goals (SDGs) or climate targets under Indonesia's Nationally Determined Contributions.

"In supporting this, we work together with different stakeholders from the government, the private sector, and so on," she said.

The Webinar - Youth Participation in Financing Climate Change Action, on Wednesday, 27th April 2022

The webinar also presented Vanessa Letizia,the Executive Director of the Greeneration Foundation and the Senior Policy Researcher for the Yayasan Indonesia Cerah, Mahawira Dillon. Both were present as facilitators in the discussion on green financing actions for waste management and renewable energy.

"The financing gap for waste management is still very large, so we must creatively look for other financing potentials," said Vanessa, sharing the conclusions of the discussion room on waste management.

"The government needs to invite more youths to discuss national climate ambitions and policy strategies," said Mahawira, summarizing aspirations of the youth in the renewable energy discussion room.

UNDP Indonesia and the Ministry of Finance hope that organizing this event will open spaces for dialogue between youth and stakeholders on climate change, and eventually inspire new initiatives and efforts to involve youth in climate finance for a systemic and sustainable change. (*)