Still Burdened by Debt Monetization

Monday, December 27, 2021

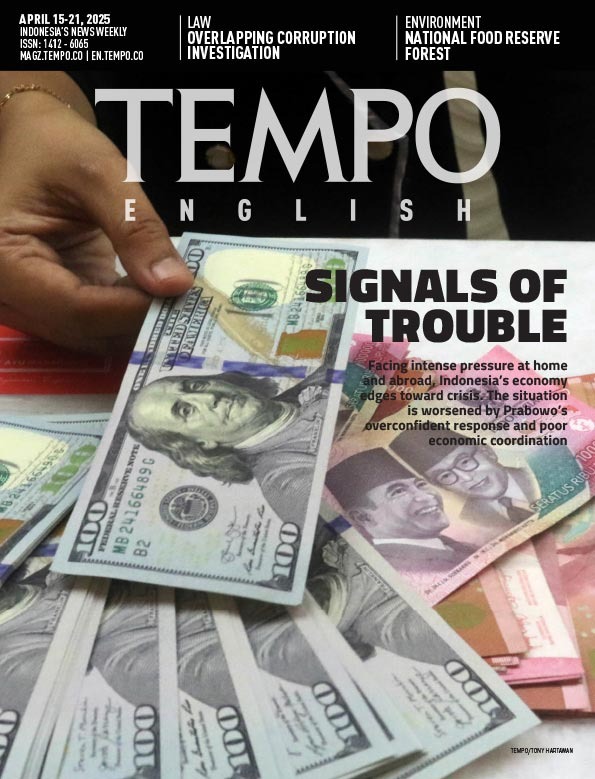

Experience from 2013 has shown that when the Fed reduces liquidity injections and raises interest rates, the resulting wave of capital reallocations can hurt the financial markets of emerging economies, including Indonesia.

arsip tempo : 174524000630.

ENTERING the New Year, there are various risks that carry negative sentiments to the Indonesian economy. Some of those risks are within anticipation and already priced in. The market, however, is never free from shocks, even more so in the volatile environment that seems set to dominate 2022.

The biggest risk is the Federal Reserve policy change. Liquidity injections by the Fed that have been the lifeblood of global financial

...

Subscribe to continue reading.

We craft news with stories.

For the benefits of subscribing to Digital Tempo, See More

For the benefits of subscribing to Digital Tempo, See More